Class size matters to Obama, that’s why he created more poor people.

… Nearly five years after the Great Recession ended, more people are coming to the painful realization that they’re no longer part of it.

They are former professionals now stocking shelves at grocery stores, retirees struggling with rising costs and people working part-time jobs but desperate for full-time pay. Such setbacks have emerged in economic statistics for several years. Now they’re affecting how Americans think of themselves.

Since 2008, the number of people who call themselves middle class has fallen by nearly a fifth, according to a survey in January by the Pew Research Center, from 53 percent to 44 percent. Forty percent now identify as either lower-middle or lower class compared with just 25 percent in February 2008.

According to Gallup, the percentage of Americans who say they’re middle or upper-middle class fell 8 points between 2008 and 2012, to 55 percent.

And the most recent General Social Survey, conducted by NORC at the University of Chicago, found that the vast proportion of Americans who call themselves middle or working class, though still high at 88 percent, is the lowest in the survey’s 40-year history. It’s fallen 4 percentage points since the recession began in 2007.

The trend reflects a widening gap between the richest Americans and everyone else, one that’s emerged gradually over decades and accelerated with the Great Recession. The difference between the income earned by the wealthiest 5 percent of Americans and by a median-income household has risen 24 percent in 30 years, according to the Census Bureau.

Whether or not people see themselves as middle class, there’s no agreed-upon definition of the term. In part, it’s a state of mind. Incomes or lifestyles that feel middle class in Kansas can feel far different in Connecticut. People with substantial incomes often identify as middle class if they live in urban centers with costly food, housing and transportation.

In any case, individuals and families who feel they’ve slipped from the middle class are likely to spend and borrow less. Such a pullback, in turn, squeezes the economy, which is fueled mainly by consumer spending.

People are generally slow to acknowledge downward mobility. Many regard themselves as middle class even if their incomes fall well above or below the average. Experts say the rise in Americans who feel they’ve slipped below the middle class suggests something deeply rooted.

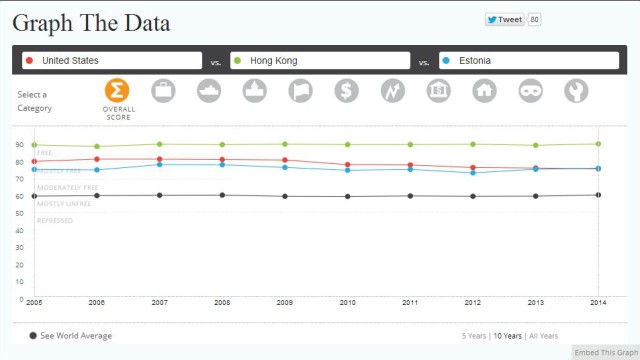

Nearly One-Fifth. One-Fifth of the Middle Class. Let’s look at a few of the causes of the loss of the American Dream. The good people over at Heritage Foundation have been so kind as to track the progress of economic freedom for the past 20 years. This year marks the first year the United States has dropped out of the top 10 since they began tracking economic freedom around the world.

At the top of the list is Hong Kong.

Hong Kong’s economic freedom score is 90.1, making it the top-rated economy in the Index for the 20th consecutive year. Its overall score is slightly better than last year due to improvements in government size and regulatory efficiency that offset a decline in freedom from corruption. Hong Kong is ranked 1st out of 42 countries in the Asia–Pacific region and 1st in the world.

Wondering which economic powerhouse kicked the United States out of the top 10? Ladies and gentlemen, I give you — Estonia. No, really. Because who doesn’t think “Economic Freedom” and “Rule of Law” regarding a former Soviet Bloc nation?

Over the 20-year history of the Index, Estonia has recorded an impressive score improvement of nearly 11 points, lifting the economy from the ranks of the “moderately free” to the “mostly free.” The country has recorded advancements in six of the 10 economic freedoms, including property rights, freedom from corruption, monetary freedom, trade freedom, and financial freedom, the scores for which have improved by double digits. Market openness has been significantly enhanced and has facilitated Estonia’s impressive transition to a free-market economy.

Meanwhile, under President Pivot’s watch, The United States has steadily declined each year since 2009, to an embarrassing rank of 12. Hmmm, wonder why…

The United States, with an economic freedom score of 75.5, is the 12th freest economy in the 2014 Index. Its score is half a point lower than last year, primarily due to deteriorations in property rights, fiscal freedom, and business freedom. The U.S. is ranked 2nd out of three countries in the North America region, and although its score remains well above the world and regional averages, it is no longer one of the top 10 freest economies.

Over the 20-year history of the Index, the U.S.’s economic freedom has fluctuated significantly. During the first 10 years, its score rose gradually, and it joined the ranks of the economically “free” in 2006. Since then, it has suffered a dramatic decline of almost 6 points, with particularly large losses in property rights, freedom from corruption, and control of government spending. The U.S. is the only country to have recorded a loss of economic freedom each of the past seven years. The overall U.S. score decline from 1995 to 2014 is 1.2 points, the fourth worst drop among advanced economies.

Substantial expansion in the size and scope of government, including through new and costly regulations in areas like finance and health care, has contributed significantly to the erosion of U.S. economic freedom. The growth of government has been accompanied by increasing cronyism that has undermined the rule of law and perceptions of fairness.

As Obama spikes the “7 Million And Counting” nerf ball, the American Middle Class are becoming an endangered species. Myself included. Instead of offering real solutions (mustn’t criticize teh precioussssss), the Dependency Democrats’ only solution is to extend Unemployment Insurance. Oh, and vilify the Koch brothers. Because Rosebud, or something. Luckily, the road to recovery is only 7 months away.